real estate funding services

india

Our Mission

Deliver the best real estate service by connect you with appropriate cheaper and genuine Lender and Investor .

Our Vision

We want to pursue excellence by pushing each other to be better every day and seeing possibility instead of limitation .

About Us

XYZ ARROW specializes in providing real estate financing solutions to builders and developers undertaking residential or commercial projects with high sales potential within India. We offer comprehensive funding options, spanning from early-stage to last-mile financing, to facilitate the successful completion of real estate ventures.

Our expertise lies in securing funds for real estate projects at various stages, including launch, mid-construction, and even stalled projects. We also offer the option to refinance existing project loans, providing additional capital to ensure project completion.Our streamlined process involves a thorough analysis of project specifics, including location, existing loan terms, and current construction status, enabling us to tailor the most appropriate financing plan.

For optimal real estate financing solutions for your project, we encourage you to contact us to explore the best financing options available across the globe.

we are dealing with all kind of property Land,Residential,Commercial,Industrial. We're Here To Help You

Our Services

Land Acquisition Finance

The initiation of a new real estate project necessitates addressing several critical factors that, if unmanaged, can impede progress, including the resolution of prior legal, social, or political conflicts. A real estate financing firm frequently manages these issues prior to securing appropriate funding. Land acquisition finance is essential for ground-up real estate developments, with its primary function being the acquisition of a building site. The expertise of a real estate financing firm is considered crucial in accurately assessing the land’s value.

Pre-construction financing

addresses the financial needs of developers prior to the commencement of construction activities. This financial instrument facilitates the completion of essential pre-construction tasks, including securing necessary approvals and completing required documentation. By providing this type of financing, a real estate financing firm ensures a consistent cash flow, thereby contributing to the timely completion of the project. Given their interim nature, these loans are typically secured by tangible assets, such as alternative properties, serving as collateral.

Construction Finance

This specialized area of real estate finance provides essential capital to developers for the initiation of commercial or residential construction projects. These funds are allocated to cover construction expenses, facilitate payments to suppliers, acquire necessary machinery, and augment working capital. Funding options encompass a range of secured and unsecured loans, often leveraging sales receivables as collateral. Given the substantial amounts involved, construction finance typically features flexible repayment terms and tenors.

Refinancing

offers borrowers the opportunity to replace their current loan with one featuring more favorable terms. This service facilitates the negotiation of improved interest rates, adjusted loan tenures, modifications to loan terms and lender arrangements, the conversion between fixed and floating interest rates, and the potential for accessing top-up loans, among other benefits.

Last-mile Funding

Last-mile funding provides crucial financial resources to finalize projects nearing completion, particularly within the real estate and logistics sectors. In real estate, this funding mechanism injects capital to complete construction projects experiencing financial constraints, facilitating their delivery to purchasers. This financing is typically deployed when a project stalls due to insufficient funds, often after the initial financing has been depleted, and is structured as a priority or sub-debt, frequently carrying a higher interest rate to reflect the associated risk.

Lease Rental Discounting (LRD)

Lease Rental Discounting (LRD) is a term loan facilitated by real estate financing entities, secured by rental income as collateral. These loans are approved following a thorough assessment of cash flow and are repaid through rental proceeds. LRD is particularly prevalent in commercial real estate projects generating monthly rental income.

Builder financing

Builder financing provides specialized capital solutions for real estate developers and builders to facilitate the completion of residential or commercial construction endeavors. This project-based loan structure addresses diverse expenses, including material procurement, contractor compensation, and administrative overhead. Loan terms are often tailored to the project’s financial scope, land acquisition specifics, and comprehensive assessments conducted by the financing institution. Funds are allocated exclusively for the designated construction project and must be utilized accordingly. Repayment structures are adaptable, potentially incorporating escrow accounts. Furthermore, this financing option can be applied to revive stalled projects. Applicants must furnish evidence of financial standing and a comprehensive, feasible project proposal. The loan is typically secured by the property under development.

inventory financing

Real estate inventory financing provides developers with short-term capital by leveraging unsold properties as collateral. This financing mechanism utilizes unsold properties, such as apartments and commercial units, as security for a loan. This enables developers to secure working capital for project completion, supplier payments, and cash flow management while awaiting property sales. Loan amounts are determined by lenders based on the valuation of the unsold inventory. Developers can then utilize this credit facility to support their operational needs. Upon property sales, the loan is repaid with the proceeds, and the collateral is released.

Project finance

Real estate project finance encompasses the long-term funding of substantial real estate ventures, leveraging a combination of debt and equity to manage project expenses throughout its lifecycle. This approach differentiates itself from standard corporate finance by relying on the specific project’s future cash flows and assets for loan repayment, rather than the overall financial standing of the parent company. Funding often involves the establishment of a Special Purpose Vehicle (SPV), a distinct legal entity designed to manage the project and mitigate risk for the parent company. The financing structure typically comprises a blend of debt instruments, such as bank loans and bonds, along with equity investments. A typical capital stack might consist of 60-70% senior debt, 10-20% mezzanine debt, and 10-30% equity. The SPV utilizes this capital to acquire land, construct the building, and cover operational expenses. Upon project completion, the generated revenue is then utilized to service the project’s debt obligations and provide returns to equity investors over a predetermined timeframe.

What is Real Estate Financing ?

Real estate funding options are accessible to builders and developers for the development of both ongoing and newly launched residential projects, provided the projects demonstrate significant market potential and offer assurances of repayment to lenders. The following are the key factors that are sensitive to raising a construction loan:

Location

The strategic positioning of real estate projects is paramount, with a strong emphasis on locations experiencing development, particularly those attracting buyer interest due to the presence of complementary projects, townships, and essential amenities such as schools and hospitals.

Accessibility

Projects that offer convenient connectivity to other areas within the city or town are highly desirable to potential buyers. Ease of access to workplaces, educational institutions, and the ability for friends and family to visit are key considerations.

Transportation

A project’s accessibility via public transportation, including buses, taxis, and auto-rickshaws, is crucial. Furthermore, the presence of metro connectivity, a rapidly expanding infrastructure component in many regions, significantly enhances a project’s appeal.

Pricing

The pricing strategy for a project must align with the services and amenities provided. Recognizing that buyers have diverse budgetary constraints, the project must deliver value for money, regardless of whether it is a luxury development or affordable housing.

Reputation of Developer

Buyers are more interested in projects that are developed by already established & reputed developers. Developers who already delivered a number of projects gain more confidence from buyers and attract buyers to purchase their projects.

All the above factors impact a project’s viability to attract a lender & their decision to provide the loan.

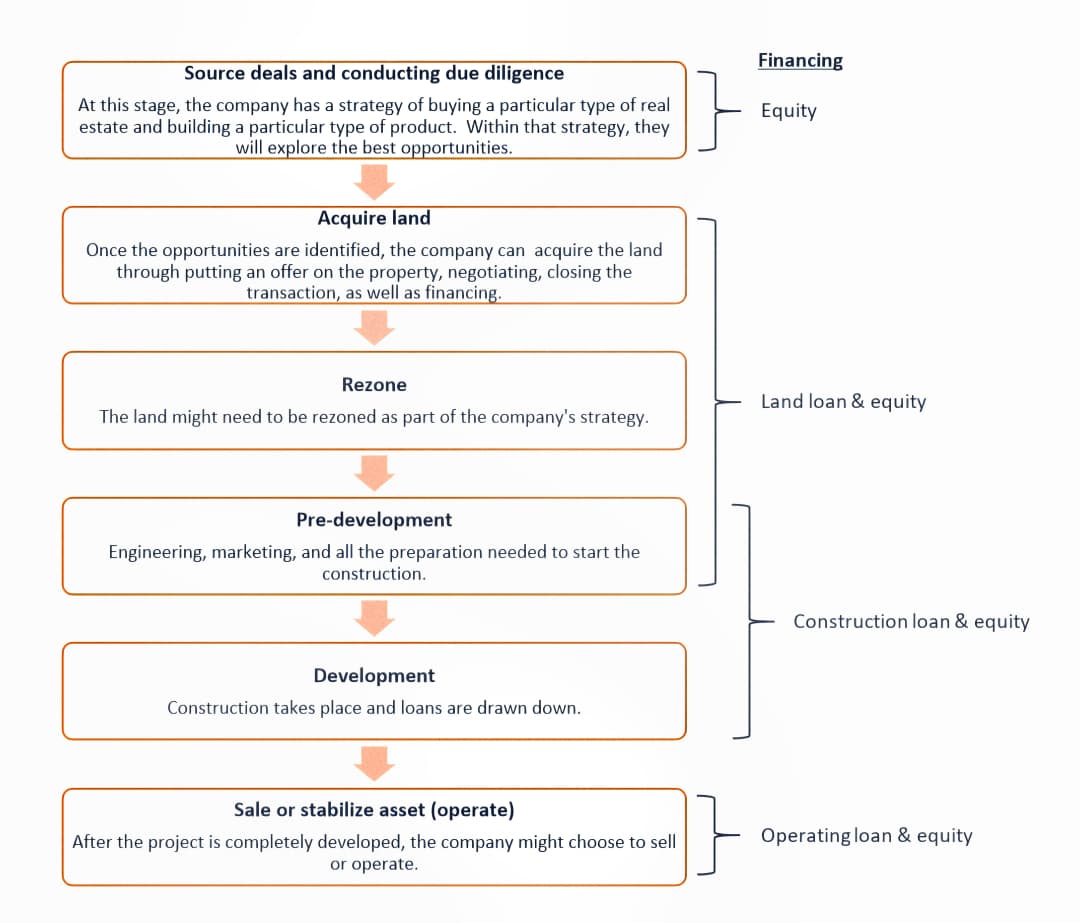

Real Estate Project Finance – Development Timeline:

A comprehensive understanding of the development process and its associated timeline is crucial for the effective construction of a real estate project finance model. The development of a real estate project typically encompasses several distinct stages.

Real estate project finance employs diverse funding mechanisms tailored to each stage of the project life-cycle. Initially, equity financing is often utilized for deal sourcing due to the inherent high-risk profile, which can complicate the acquisition of bank loans. As projects advance to later phases, such as rezoning and pre-development, a combination of debt and equity financing typically becomes the standard approach.

Why Choose Us

IN REAL ESTATE SERVICES WE ARE UNIQUE AND BEST SERVICE PROVIDER BECAUSE WE HAVE TIE-UPS WITH CERTIFIED BEST LENDER AND INVESTOR ACROSS GLOBE

Expert Guidance:

Our experienced team supports you at every stage, from pre-disbursement to post-disbursement, ensuring guidance and assistance throughout the entire loan tenure.

Simplified Documentation:

We take care of the paperwork for you, ensuring a smooth and hassle-free process while saving you valuable time.

Strong Negotiation Skills:

We’ll ensure you get the best terms and pricing available, tailored to your needs and designed to provide maximum satisfaction. Your success is our priority, and we’ll negotiate on your behalf.

Market-Driven Insights:

Our comprehensive market analysis equips you with the insights needed to make confident, well-informed decisions, empowering you to navigate opportunities with clarity and precision.

Let's Build Your Dream Project Today

Contact us

Leave us a note and we will get back to you for a free consultation

- +91-8260673300

- invest@xyzarrow.com

- Globally